SFH LANDLORDS & THOSE CONSIDERING TO BE

There is a Time to Buy & a Time to Refi … Right Now!

Single family home rental investors agree … the terms of purchasing and investment property are critical to success. There are two pieces to the purchase puzzle:

- Property price, and

- Cost to finance the investment.

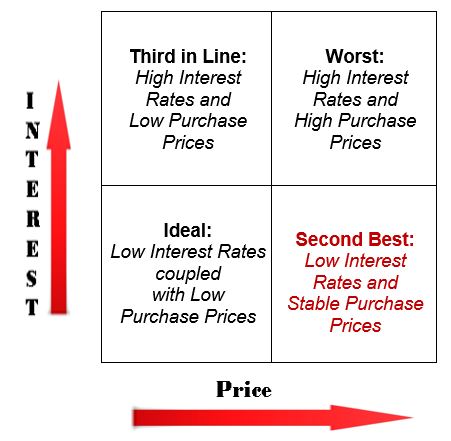

In a perfect world, both of these key elements would be in alignment to the benefit of the SFH investor … bargain purchase prices and low cost of borrowing. That said, there’s no way to forecast the presence of both in the same time-frame that a current (or wannabe) landlord is prepared to invest. So, let’s take a look at the best and less-than-best circumstances to acquire or refinance an SFH rental property.

Ideal: Low Interest Rates coupled with Low Purchase Prices

Second Best: Low Interest Rates and Stable Purchase Prices

Third in Line: High Interest Rates and Low Purchase Prices

Worst: High Interest Rates and High Purchase Prices

There are investors who have done well in each of the above circumstances. That said, I believe significant opportunities present themselves in this economic environment of:

Second Best: Low Interest Rates and Stable Purchase Prices

While there may be bargains to be found elsewhere, the sweet spot for investing in residential real estate is affordable, workforce housing … not new construction or high-priced suburbia. Currently, KRS Holdings is enjoying great demand by quality credit risk tenants for single-family-homes and apartments in safe, reasonably priced neighborhoods.

With that profile in mind, this is an excellent time to refinance existing holdings and/or borrow for an addition to your portfolio. Here is my rationale for this belief.

Let’s start with the current climate of low interest rates. A brief lesson. Real estate lenders base their loan pricing on the 10-Year Treasury Bond rate + 170 basis points (1.7%). Rates are exceptionally low today with 4% interest or less available for 30-year financing.

Fed officials have indicated that they expect to keep rates this low for a number of years to help jobs return to pre-pandemic levels. The Fed does not expect to see inflation pick up for years, and it is willing to keep rates at zero even after it does. Its latest economic forecast shows it will keep interest rates at zero at least through 2023.

What can this mean for investors? Specifically, the striking opportunity to capture long-term financing that keeps debt-service costs low when rates increase … as they surely will post-COVID-19. Likewise, as inflation increases so will your opportunity to increase rents.

While it is likely that asset appreciation will stall or at least be limited, paying down the mortgage note at low rates accelerates building equity in the property. More of each payment will be applied to principal.

So, as KRS Holdings seeks to expand its portfolios for our clients and our company, our guiding principles are based on confidence that when it comes to acquiring rental properties now is …

Second Best: Low Interest Rates and Stable Purchase Prices

With interest rates at record lows … and SFH prices stable

now is a good time to save money and build equity!

Summary

The key to success as a SFH landlord is to remain alert and diligent in serving your tenants and protecting your investment. In this economic climate, don’t miss the opportunity to buy or refi single family rental properties … as you initial purchase or to expand your portfolio.

Note: Whether becoming a landlord was a choice or a result of circumstance, it doesn’t change the fact that managing any property comes with its challenges… and we want to help. At KRS Holdings, we stand by our core principles to always be straightforward and honest in every situation. We strive to make our clients the most money possible. We’d love to share with you how we can make your property profitable and relieve you of the management stresses imposed by COVID-19.

Give us a call or drop an email. We’ll respond promptly and

relieve your stress to evaluate your property management options.